An index is a combination of stocks of leading global companies that our company has ‘packaged’ for the convenience of the investor. Indices usually have a basket of underlying assets and do not change. Indices compiled by our company are constantly changing, rebalancing is done to maximise profits.

Our team is constantly changing the set of stocks in the index, unlike other companies. If a stock has a prospective loss, we immediately remove it from the index and replace it with a more promising stock more promising.

Buying an index, you do not need to follow the quotes and make any actions. Our specialists do everything to make sure that every day you have a guaranteed profit.

Indexpod individually collected index return, which is specified in your personal account. You always earn according to the purchased index.

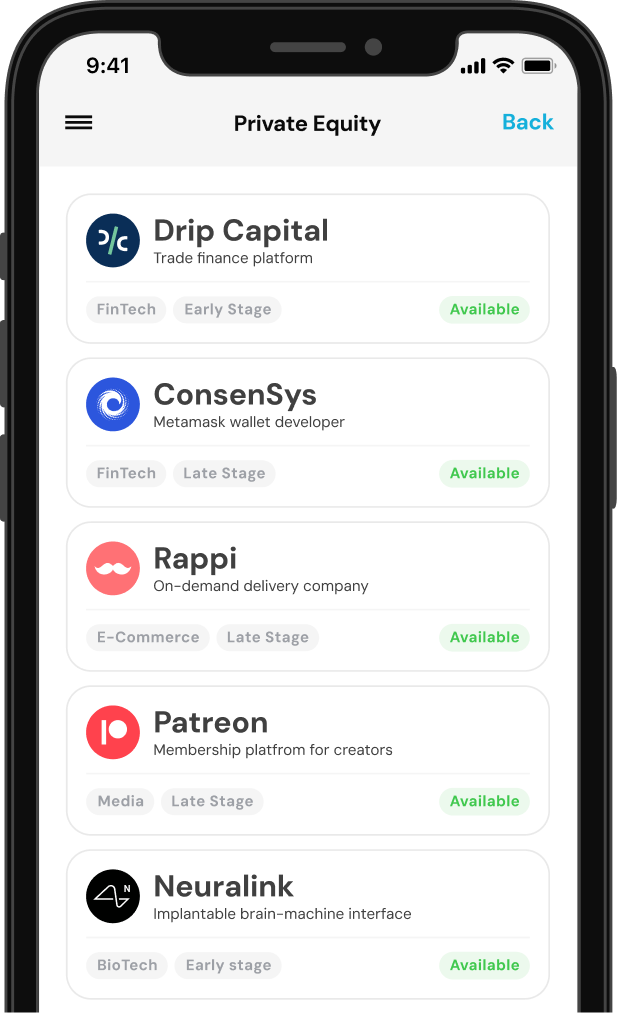

Invest in private companies that are inaccessible to a wide range

of investors. Earn money with our multi-stage

venture fund

You invest in world-changing technologies and get higher returns. According to historical data, over the long term, venture capital investments show the highest returns compared to real estate, stocks and other types of assets.

Our expert analysts carefully select companies at different stages and in different industries. We invest in more mature startups with stable value, working technologies, proven business models and support from leading venture capital firms.

Main focus is on fintech, cybersecurity, artificial intelligence, space technologies, and web3.

Invest in the private companies that are shaping our future before they go public and become publicly traded. Get ahead of the curve and earn multiples more.

Our team is constantly balancing the portfolio, buying stakes in private companies (startups) and reselling them

When withdrawing funds you do not pay any commissions, they are included in the investment plans. When depositing funds, you pay the commission of the selected payment system

Companies remain private for quite a long time. When they become available to a wide range of investors, the demand for shares becomes colossal. Since our company has a significant stake in the stakes, when the company goes public, we sell all or part of this stake. High demand generates high value. Often, a company earns hundreds or tens of hundreds of per cent on a given event. Public stocks have a high potential for returns over a medium to long horizon. As for IROs, you get returns a short time after you invest.

Public stocks have a great potential for returns over a medium to long horizon. As for IPOs, you get profit after a short period of time, after investment.

Investing in ІPO, you earn much more than investing in venture capital, as well as in indices.